Welcome to Week 1 of the 12-week DEBT DESTROYER Challenge companion to the Financial Foundations 30-Day Challenge!

Introduction to the Program

The core curriculum remains the same, and I highly encourage to follow along. The course includes:

- Video Lessons – Walks you through step by step. Veterans are OK to skip.

- Weekly Attack Plan – Start the week with intention.

- Daily Pomodoros – Daily 20 minutes or whichever cadence works for you…this is merely meant interrupt patterns of avoidance.

- Spend Offensives / Income Influxes – In corporate, the worst employers I’ve had “cut their way to success”. That is just survival. Cut the fat, but focus on those income influxes. They are cathartic and you can actually generate a lot!

- Drive the Wedge – This takes many forms. I recommend weekly, but you choose your own cadence here. MOST IMPORTANTLY – Post about it. This is what it’s all about and you should CELEBRATE.

Week 1 is about getting your house in order, so if it’s been a while since you’ve taken stock, or listed your obligations, take the time to do that.

Wednesdays I’ll post a War Room topic for discussion. We will continue to hold war rooms on Friday at 12pm CST. If you would like to propose a change, we can do that!

War Room – The last round expanded my mind in so many ways. While we primarily focused on the Infinite Banking Concept, the reframe…or mindf#$k…was very powerful. The weekly war room topics will seek to flesh out similar reframes.

- Infinite Banking Concept

- Perpetual Budgeting

- Debt for Growth

- Neuroscience and Decision Making

- Third Way Man Financial Principals – Started Last Round

I’ll leave you with this, like the start of Hidalgo, there is a tendency to go hard out the gates. We are seeking an infinite mindset to put us in the flow. Find your cadence that will last, and let’s go get ours!

~Coach David Kaiser

1. Debt Destroyer Lesson

Watch the overview video plus two assignment videos in Module 1 (approx 20 minutes total) and post a proof pic/screenshot showing the end of the last video. (2 points)

Overview

Video 1

Video 2

2. Debt Destroyer Mindset Exercises

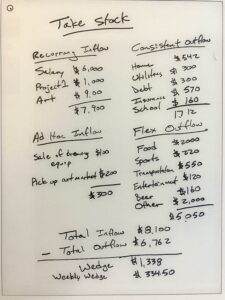

Assignment 1: Take stock of your financial inflows and outflows

After watching the lesson videos for this week, utilize the DD WK1 Workbook, a fresh sheet of paper, or you can utilize the “Debt Destroyer Tools and Templates” spreadsheet to create your “Taking Stock” worksheet.

On the left hand side, write out your Recurring Inflows (Salary, side-income, residual income, etc.) and Ad Hoc Inflows. On the right hand side, write our your Consistent Outflows (commonly “fixed” costs) and Flex Outflows.

At the bottom of the page, subtract your Total Outflow from your Total Inflow and the result will be your monthly Wedge*. Finally, divide the wedge by four (4) and the result is your targeted wedge to apply for the week.

The wedge represents the Free Cash Flow (FCF) available to reduce debt.

*Note that a negative result is the amount your debt is growing each month. Do not worry, you will turn this around!

Proof pic: Upload a photo of your “Taking Stock” worksheet (or a quick video flipping through the multiple pages) to your fire team channel.

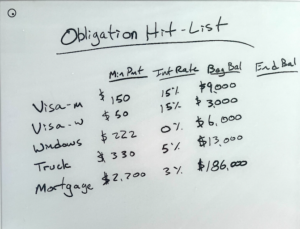

Assignment 2: Create your Obligation Hit-List

On a fresh sheet of paper, the DD WK1 Workbook, or the “Debt Destroyer Tools and Templates” spreadsheet, create an “Obligation Hit-List.” List out every debt obligation with the Minimum Payment, Interest Rate, Beginning Balance and a column header for ending balance.

Proof pic: Upload a photo or screenshot of your Obligation Hit-List to your fire team channel.

Assignment 3: Create your Weekly Attack Plan (5 points)

In the DD WK1 Workbook, a fresh sheet of paper, or the “Debt Destroyer Tools and Templates” spreadsheet, create a “Weekly Action Plan.” Below the title write the weekly wedge calculated on the “Taking Stock” page.

Draft three (3) Spend Offenses, efficiencies, eliminations and intelligence into how you spend your money. Hint – Review your Flex Outflow list for waste!

Spend Offensive Examples:

- Cancel a subscription

- Shop for a week of BOW compliant groceries

- Cancel your PMI Insurance (if able)

Draft three (3) Positive Influxes, hustles, initiatives and easy wins to generate cash inflow.

Positive Influx Examples:

- Change your W2 withholding

- Sell something to make space in your garage

- Call a new potential client

Sum all initiatives to calculate your Estimated Free Cash Flow (FCF) potential.

Proof pic: Post a proof pick of you Weekly Action plan to your fire team channel.

Assignment 4: DAILY Spend Offenses OR Positive Influxes

For 4 days this week, set your timer for 20 minutes and focus on one (1) Spend Offensive or one (1) Positive Influx. You are not measured by effectiveness, you are simply devoting time and intentionally making bold moves with your money.

Proof pic: Upload a picture of your daily action each day to your fire team channel.

Assignment 5: Review your week and Drive the Wedge

At the end of the week, spend some time going back to think about your week. What worked? What did not? Note your successes and ensure you provide a dollar value.

At the bottom of the sheet, input your Weekly Wedge, your Estimated FCF and Actual Wedge.

Drive the Wedge: Chose an obligation from your Obligation Hit-List and transfer the value of the actual wedge created to the principal balance. This is the single most important step in the entire program.

Proof pic: Post your Weekly Review to your fire team channel.

3. BOLD MOVE

Make one Bold Move this week to move the needle in any area of your life (For example your health, wealth, relationship, family, work or personal life). It is strongly recommended (though not required) that you make a Bold Move that is directly related to one of your Debt Destruction actions.

Proof pic: Upload a photo or video of your Bold Move to your fire team channel. (5 points).

If you need more information about the concept of Bold Moves, refer to the 50 BOLD User Manual.

4. Special Ops (5 points)

Your Special Ops assignment for this week is to complete ONE of the three Special Ops listed in the #core-special-ops channel in Slack (link below), and to substantiate by uploading a proof pic or video to your fire team channel. (5 points)

5. MOOT

Join us Friday at 3 PM Central Time for our weekly Moot. Zoom link and password will be posted in Slack each Friday.

Proof pic: Upload a photo or screenshot of the Moot to show you attended the live Moot or watched the replay (5 points).

KILL A BILL WAR ROOM

Every Friday at 12pm CST we will hold an open Zoom call to work assignments, share wins and see who can bring the worst hold muzak when calling vendors. This call is not mandatory, just a block of time you can use to focus on destroying your debt. Zoom details will be posted in the 03-debt-destroyer channel.

Quick Links:

Debt Destroyer Tools and Templates

Debt Destroyer Scoring Tracker Template

For DEBT DESTROYER Support: Send a direct message in Slack to @Coach David Kaiser

For general Third Way Man or 50 BOLD support inquiries, please email support@thirdwayman.com

…

Now go out and Destroy Your Debt, win some points, and put your fire team on the leaderboard.

See you on the Moot!

David Kaiser, 50 BOLD Coach

Third Way Man